Greenhouse for a Global Financial Services Firm

Greenhouse is our applied training programme in service design and policy design. To explore and test the tools, Greenhouse is always focused on an applied challenge as an example based on the UCD process.

We recently partnered with a global financial services and insurance business to work with them in enhancing an internal design capability to innovate their offer refocusing on users. And this is where we came in with Greenhouse...

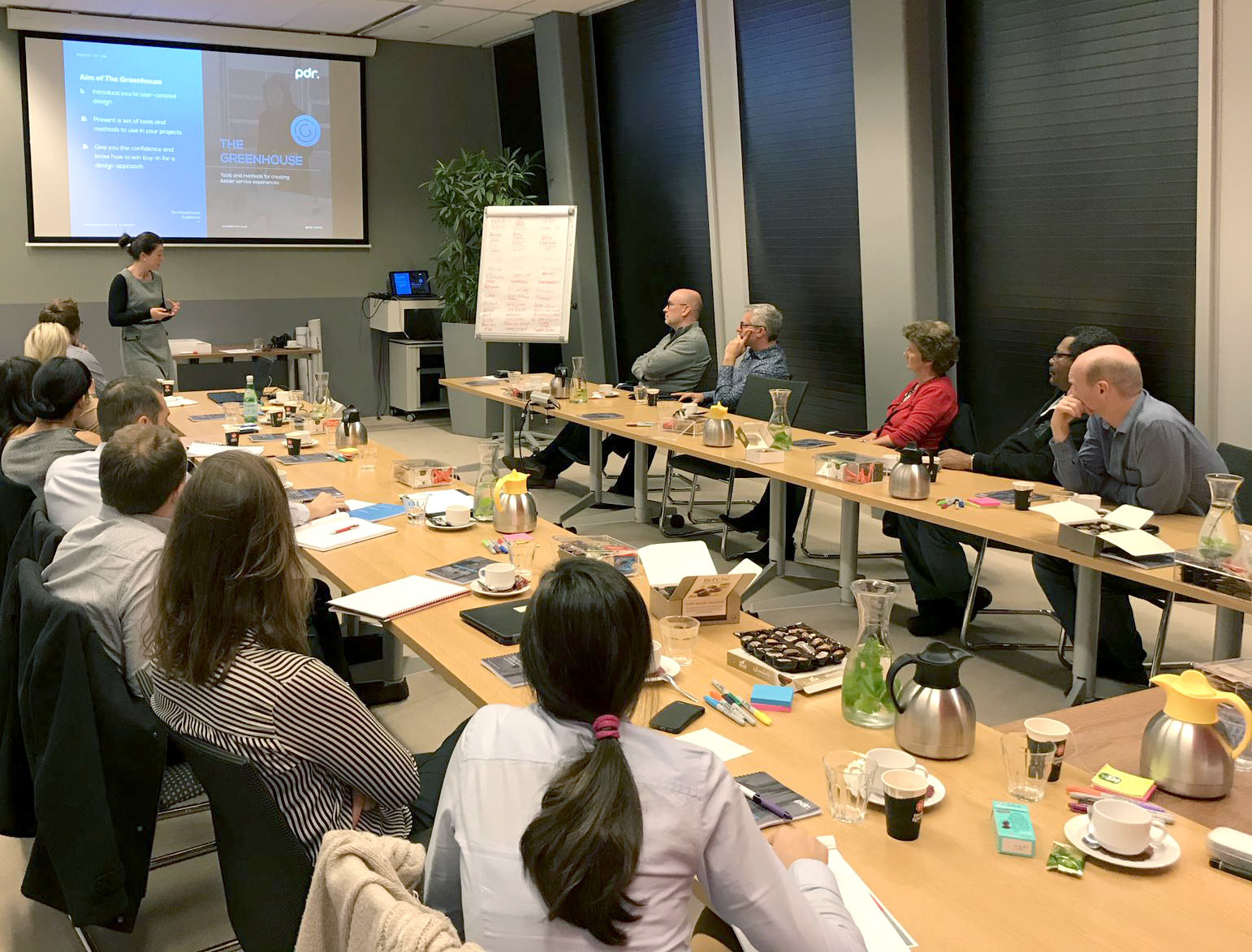

Team members from around Europe joined us for an immersive two-day Greenhouse session. The client set the challenge around:

"How can we make it easier for brokers to recommend us as the provider of choice?"

After an icebreaker exercise, we dived into the theory and practice on the cascade from policy to practice to the public and the corresponding roles of policy design, service design, and user-centred design at each stage.

The client’s Business Analysis Manager, presented the challenge and in groups, we used PDR's Problem Definition tool to drill down into the challenge and explore some fundamental questions:

· What do we mean by brokers?

· Why are the brokers important to us?

· What services do we currently offer our brokers?

· What are the challenges?

· What does success look like?

The teams continued by performing a Stakeholder Mapping of the wider service ecosystem and developing a series of Personas representing key users such as large and small brokers and customers. This exercise revealed a number of opportunities to refocus attention on the needs of some of its core users and as such, the groups used the PDR User Research Framework to plan a number of user insights studies to more effectively address user needs.

At the end of the first day, the participants mapped three User Journeys identifying all the touchpoints, interactions, and milestones of a particular journey. The three User Journey Maps focused on prospective customers (how a broker connects with the client through to exchange of contracts), policy renewal (how customers experience the policy renewal process), and ‘a day in the life of’ a broker (understanding the service interactions between a broker and the client).

The groups were able to pinpoint some pressure points on the journeys and identify where the opportunities for service interaction and relationship management could be further improved.

On the second day, participants were introduced to Speculative Design and how we at PDR use it as an innovation method as well as its other functions within policy and service design. To get the workshop participants into the ‘speculative’ mindset, participants were given the challenge of ideating over a hundred ideas on the potential uses of a pencil.

Using different levels of provocation, they were able to think divergently and found this process insightful. The method was then applied to the concepts explored on the first day to understand how speculative design could generate new ideas for the development of the client.

After completing this ideation phase, the ideas were categorised and selected based on a balance between viability and impact. Using the ‘Detail and Scope’ tool participants selected ideas based on their impact potential and the feasibility of their creation. At this point, some very interesting themes began to emerge with participants observing how they had taken very individual perspectives depending on their past experiences with brokers and customers.

After selecting the most viable ideas, members of the workshop were encouraged to produce prototypes of their concepts of the future. Centred around the theme of apps and streamlined services, each group produced prototypes, including paper-based user interaction of an app and one role-play scenario between customers, brokers, and internal services.

The prototyping activity clearly showed useful insights during the role-play scenario which highlighted how a new approach might improve services between the respective users involved in each scenario. Based on the prototypes, the final activity was service blueprinting. Using the Service Blueprinting tool, members of the workshop planned the actions and knowledge required to be able to implement ideas generated.

Overall, there was a clear consensus from workshop participants that the concepts developed were relevant and moreover critical to the current position within the market and the relationships between brokers and customers. Crucially, participants discovered how they could be an active driver of future led user-centred design solutions.

Realising the potential of service design, we are looking forward to taking further steps in the journey in December and to delivering the next phase of capacity building in design methods.